Key Points:

- U.S. to impose new tariffs on Chinese semiconductors and electronics.

- Earlier exemptions on smartphones and computers may be reversed.

- Tech giants face rising production costs and market volatility.

- China responds with retaliatory tariffs up to 125%.

New Tariffs Aim to Reshape Tech Supply Chains

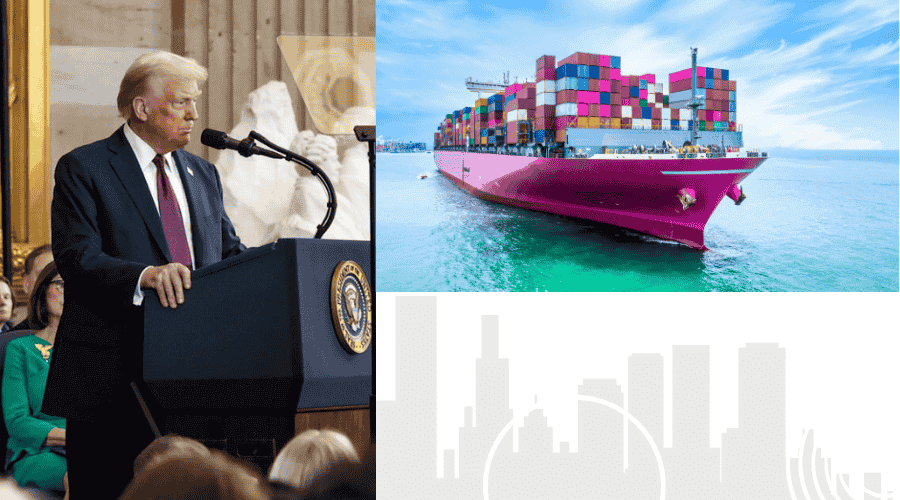

President Donald Trump has announced an aggressive new round of tariffs targeting Chinese semiconductor imports, in what he calls a bid to protect national security and reshape the high-tech manufacturing landscape. While the administration had briefly spared smartphones and computers from the 145% reciprocal tariffs, those exemptions may soon expire.

“We are taking a look at semiconductors and the whole electronics supply chain in the upcoming National Security Tariff Investigations,” Trump said aboard Air Force One. “We want to make our chips and semiconductors and other things in our country.”

Commerce Secretary Howard Lutnick echoed the urgency, stating that critical tech products from China will face new duties alongside semiconductors and pharmaceuticals within the next two months. These tariffs, he said, would exist outside the existing reciprocal structure and target smartphones, computers, and other electronics directly.

Tech Giants React and Global Supply Chains Shift

Tech companies and investors had briefly celebrated a Customs and Border Protection notice that excluded semiconductors and key electronics from the steep 145% tariffs imposed earlier this month. Analysts at Wedbush Securities called it “a big step forward” for companies like Apple and Microsoft.

However, signs of impact are already visible. Nintendo postponed U.S. preorders for its new Switch 2 console, originally priced at $450. Industry experts say it may now retail for over $600 if new tariffs are applied.

Meanwhile, China’s Semiconductor Industry Association issued guidance that may allow U.S. chip firms like AMD and Qualcomm to avoid retaliation. Chips designed in the U.S. but manufactured in Taiwan would be classified as Taiwanese origin and thus not subject to China’s counter-tariffs. Intel, however, which manufactures domestically, could face tariffs as high as 125%, causing its stock to drop over 6%.

Back in Washington, the White House insists the strategy is about independence. “President Trump has made it clear that America cannot rely on China to manufacture critical technologies,” said press secretary Karoline Leavitt. Karoline added that Apple, Nvidia, and TSMC are already accelerating plans to onshore production.

Still, not everyone is convinced, with Senator Elizabeth Warren criticizing the approach as chaotic and disruptive to both markets and consumers. The S&P 500 has fallen over 10% since January, with tech stocks leading the drop.

While the tariff initiative may spur local manufacturing, it also poses cybersecurity concerns. The rushed realignment of supply chains could create vulnerabilities, including gaps in quality control, workforce training, and infrastructure security — especially during the transition to onshore production.